Engagement Rates vs. RPC: Why Engagement Rates Matter More

By: Tyler Gillies

July 9, 2024

By: Tyler Gillies

July 9, 2024

For creditors to thrive in today’s financial environment, they must abandon the outdated approach of treating borrowers alike, and recognizing them as individuals with unique preferences and needs.

Without this shift in perspective, creditors put their collections and recoveries rates at risk and give their competitors the upper hand in underwriting future borrowers.

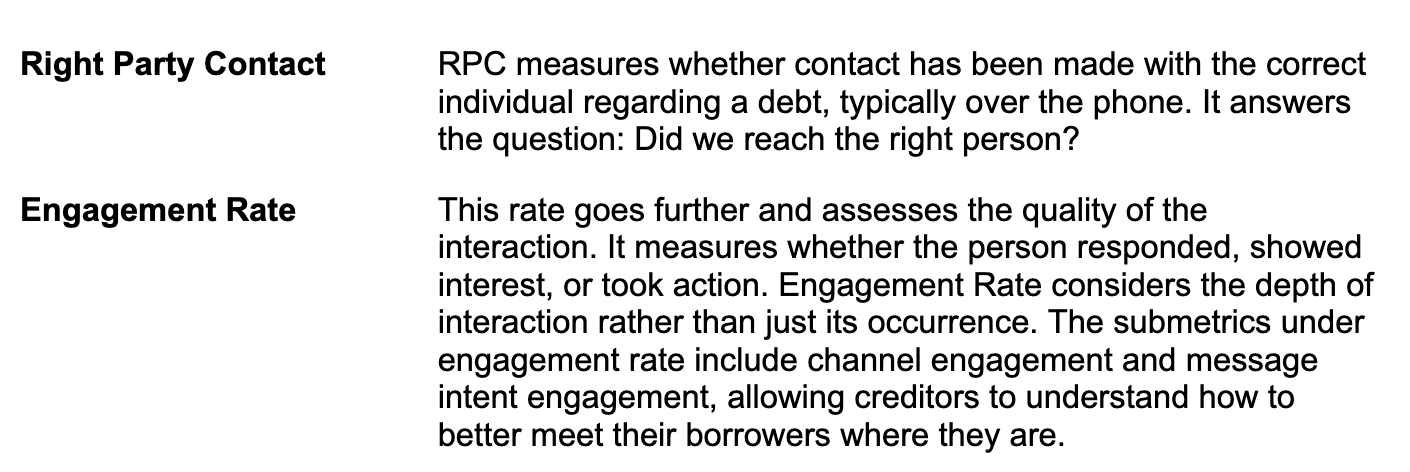

An important aspect of this shift is correctly measuring their performance, either by Engagement Rates or Right Party Contact (RPS).

We believe Engagement Rates provide a clearer and more comprehensive picture of success, and it gives creditors a view into the different types of borrowers they have in their portfolio.

Understanding the Metrics

The Limitations of RPC

The Advantages of Engagement Rates

Practical Applications

Customized communication

Different consumer cohorts prefer different channels and message types. Tracking and optimizing engagement rates opens up more options for consumers. This data reveals channel preferences and their propensity to pay.

Resource allocation

Optimizing self-service channels can save live agents more complex interactions. Focusing solely on RPC leads to an overemphasis on phone calls, neglecting other channels and deprioritizing lower balance accounts.

Continuous improvement

There is vast data available throughout the collections funnel, from “awareness rate” (email opens) and then engagement rate. Ignoring these additional data points misses insights that drive innovative strategies across channels.

Conclusion

While RPC is a valuable metric, it’s limited and doesn’t provide a full picture of performance.

Engagement rates, paired with channel specific performance offer deeper insights into communication effectiveness and the likelihood of positive outcomes. By prioritizing engagement rates, agencies and creditors can achieve more meaningful interactions, improve borrower relationships, and achieve higher recoveries.

At January, we leverage additional metrics, such as engagement rates, to drive success for our clients and their customers. Our team prioritizes a diverse dataset and advanced analytics models to improve scoring and increase the net present value of any account placed with us. Understanding and improving borrower engagement is key to long-term success and better financial outcomes for all partners involved.

Request a demo to see our platform and how we maximize AI-driven analytics, including engagement rates, to help you reach your goals.

August 28, 2024